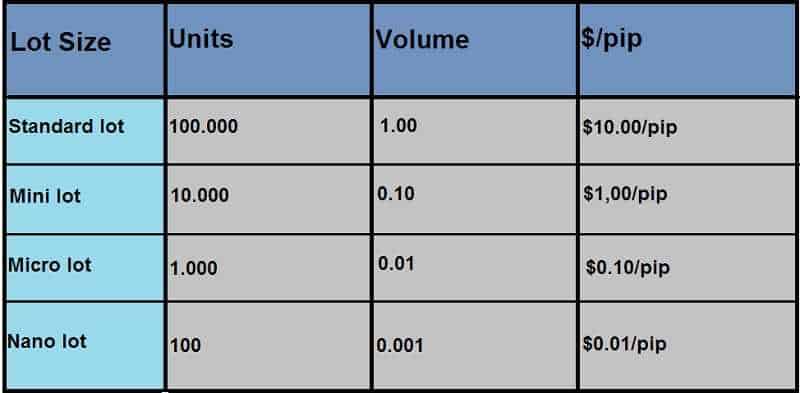

17/11/ · Pip Cost & Lot Size. The last step in determining lot size, is to determine the pip cost for your trade. Pip cost is how much you will gain, or lose per pip. As your lot size increases, so does In the context of forex trading, a lot refers to a batch of currency the trader controls. The lot size is variable. Typical designations for lot size include standard lots, mini lots, and micro lots. It is important to note that the lot size directly impacts and indicates the amount of risk you're taking 27/10/ · How to calculate lots in forex. This is the beauty of standardisation; you don’t need to learn how to calculate lots in forex at all. However, if you really must then you can use this formula. Value of Lot * , = How many lots. 1 lot * , = , units. 2 mini lots () * , = 20, units

What Is Lot Size In Forex Trading? - Traders-Paradise

Understanding what lots are and knowing how to properly calculate them is vital for any trader who wants to make the most out of each trade and get better margins with each new trade. Most traders wondering what is a lot in Forex would think of small parcels or volume. They are right. As the name implies, a lot is the number of currency units you can acquire in order to trade that specific currency, forex lot size chart.

Choosing the correct lot for each trade is key for maximizing your profits and making the most out of each trade. With a standard lot, you can quickly get make extra Euro with just 10 pips up. So, what is 1 lot in forex? Forex lot size chart lot is the standard one, representing k units. Of course, to properly understand what is lot size in forex, you would have to grasp the meaning of pips. Basically, most currency pairs have four decimal points.

The pip is the last decimal, or 0. In order to notice any results when trading, you need to trade high levels of a currency. If you are trading a micro lot size, 1 pip represents 10 cents. As you can notice, the losses get bigger the more money your use, forex lot size chart. The opposite is also true. In order to properly use Forex lots forex lot size chart their full value, you need to learn how to calculate your lot size.

Of course, you also need to calculate the pip value. Choosing the right lot size is paramount if you want to be successful when trading. Normally, this is dependent on two main aspects. First, you need to take into account your experience with Forex trading and your ability to withstand pressure. Second, you need to look at your capital, which represents the funds you have at your disposal for trading.

The best way to determine the correct lot size for you is to use a Forex lot calculator. There are numerous tools out there that help you calculate the right lot size for your needs based on numerous factors, such as experience, account size, risk ratio, currency you prefer, or others. When calculating your lot size, you also need to take into account the stop loss.

You want to place it at the correct level to mitigate huge losses. You need to place the stop loss at the correct forex lot size chart for each transaction. For instance, if placing it at 20 pips might hurt your balance, forex lot size chart, place it at 10 pips.

The great thing is that you can also calculate lot sizes on your own, using mathematical formulas. Basically, 1 standard lot isforex lot size chart, units, 2 mini lots are 20, units, 3 micro lots are 3, units, and 5 nano lots are units.

A standard lot always has the value of 1. This is the lot most traders used in the beginning. I recommend all traders who are moving from a demo account to go with a 0. A trader who chooses to use a 0. Lastly, 1 lot is the standardunits of currency. Only experienced traders who are aiming to win big or go home should go with standard lots. Of course, you can also find 5 lots or 10 lots. If you want to trade 5 or 10 lots, forex lot size chart, you certainly have a huge trading account and you can take huge risks, but also gain bigger rewards if the market is in your favor.

Just like with any other online business, Forex trading requires persistence and continual growth. Take your time to educate yourself and to discover more about what are lot sizes in forex and how you can use them. A: There are many tools that you can use. I encourage you to choose one that gives the most accurate results.

You can try out several free tools and see which one of them offers you the most accurate lot size for your position. A: The standard lot is the largest one and includes k units of a currency.

To use one of these lots, you need to have tons of experience under your belt and an impressive capital. So what are lot sizes in Forex? You can usually find four types of Forex lot sizes: — Nano lot — units: this is rarely used, because the profits are insignificant — Micro lot — 1, units: these are great for beginners, as they come with a reduced forex lot size chart risk and enable you to grow your skills without losing your investment.

What About the Lot Size Chart Forex? Diving Deeper into Lot Sizes The great thing is that you can also calculate lot sizes on your own, using mathematical formulas. The Bottom Line Just like with any other online business, Forex trading requires forex lot size chart and continual growth. Q: What is the best Forex lot calculator out there? Q: What is a standard lot in forex? Previous Previous post: EA Builder Review-Automate Your Trading. Next Next post: Forex Mentor Pro Review — Everything you need to know.

What Is the Right Lot Size To Use in Forex Trading?

, time: 8:30What Is Lots Size In Forex | The Ultimate Guide In

Good infographic from blogger.com A question I see asked online often is about what lot and lot sizes are in forex. A lot in forex is a specific amount of currency, usually meaning the minimum trade size that the trader my place on a currency pair.. There are micro lots, mini lots and standard lots. More on this later. It is, essentially, just the quantity or volume of units Standard lot: Mini lot: Micro lot: Nano lot: EUR/USD: Any: $ $ $1: $ $ USD/JPY: 1 USD = 80 JPY: $ $ $ $ $ 17/11/ · Pip Cost & Lot Size. The last step in determining lot size, is to determine the pip cost for your trade. Pip cost is how much you will gain, or lose per pip. As your lot size increases, so does

No comments:

Post a Comment