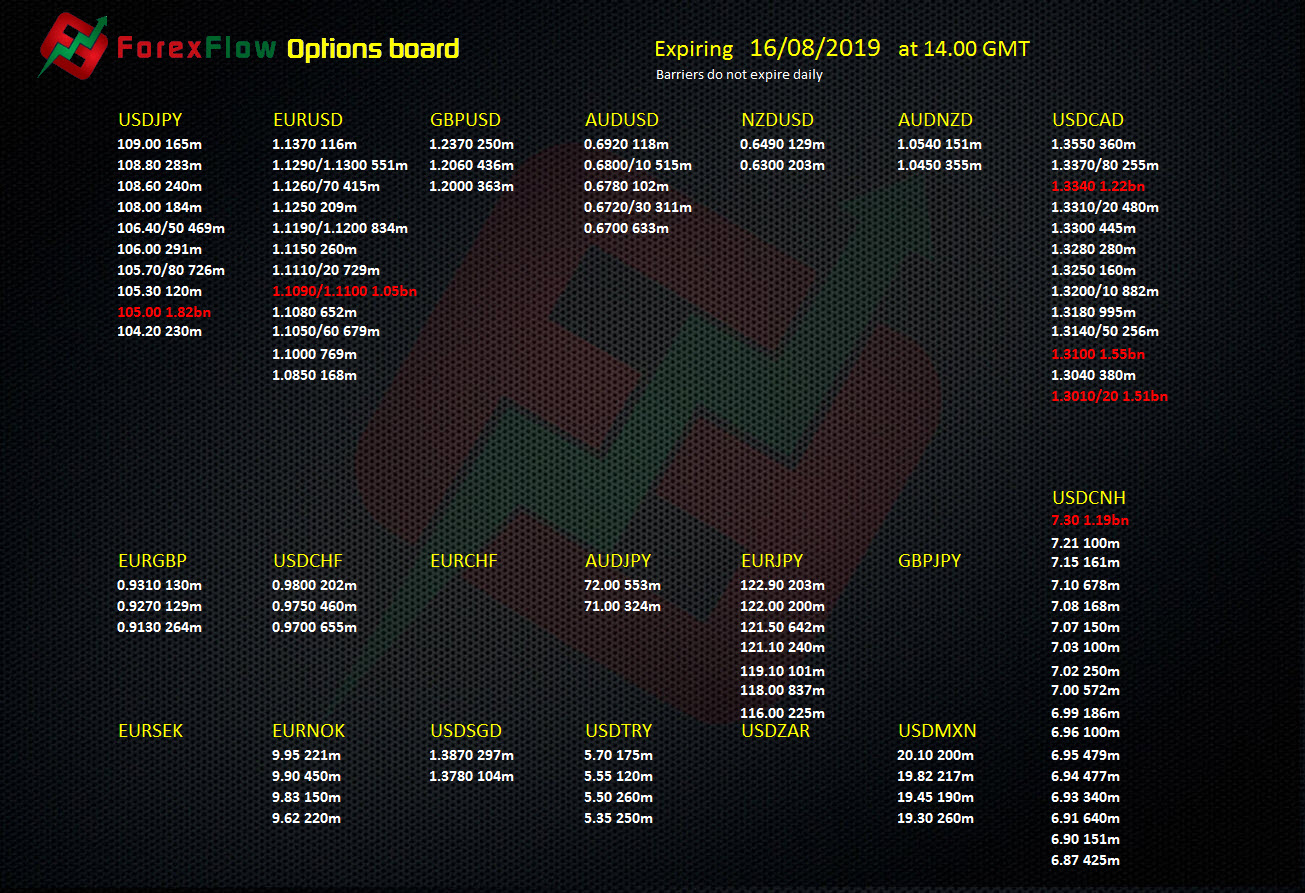

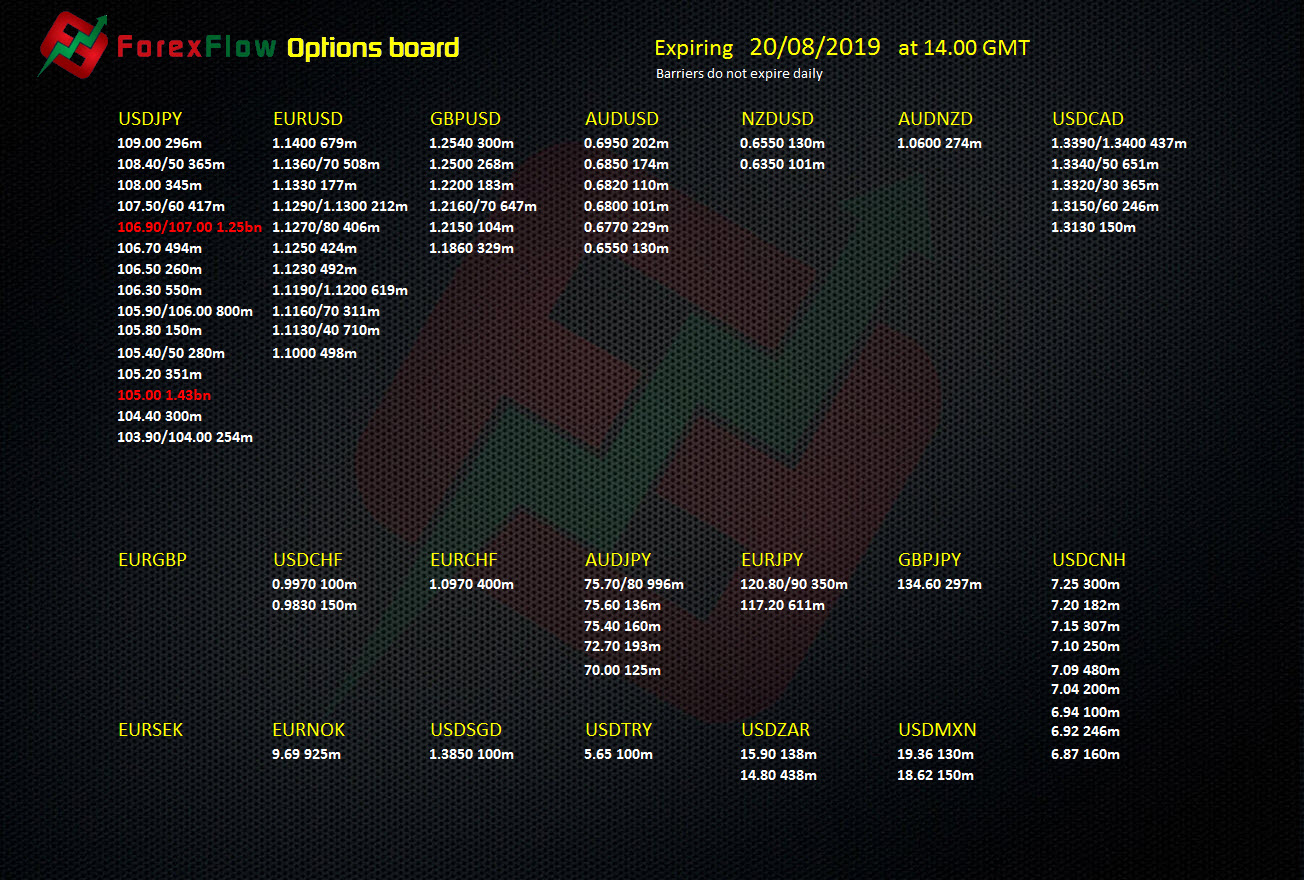

Thank you for visiting the Forex Academy FX Options market combined volume expiries section. Each day, where available, we will bring you notable maturities in FX Options of amounts of $ million-plus, and where these large combined maturities at specified currency exchange rates often have a magnetic effect on price action, especially in the hours leading to their maturities, which happens daily at FX option expiries for Apr 29 NY cut at Eastern Time, via DTCC, can be found below. - EUR/USD: EUR amounts m /40 m 26/04/ · FX option expiries for 20 April 10am New York cut; Central Banks. Bank of Japan monetary policy meeting concludes Tuesday 27 April - preview; Federal Reserve FOMC meeting Wednesday 28 April

Forex Options | Forex Academy

Forex options are derivatives based on underlying currency pairs. Trading forex options involves a wide variety of strategies available for use in forex markets. The strategy a trader may employ depends largely on the kind of option they choose and the broker or platform through which it is offered. The characteristics of currency options trading include a decentralized forex market that varies much more widely than options in the more centralized exchanges of stock and futures markets, forex options.

Options traded forex options the forex marketplace differ from other markets in that they allow traders to trade without taking actual delivery of the asset. Forex options trade over-the-counter OTCand traders can choose prices and expiration dates which suit their hedging or profit strategy needs, forex options.

Unlike futureswhere the trader must fulfill the terms of the contract, options traders do not have that obligation at expiration. Traders like to use forex options trading for several reasons.

They have a limit to their downside risk and may lose only the premium they paid to buy the options, but they have unlimited upside forex options. Some traders will use FX options trading to hedge open positions they may hold in the forex cash market, forex options.

As opposed to a futures market, forex options, the cash market, also called the physical and spot market, has the immediate settlement of transactions involving commodities and securities. Traders also like forex options trading because it gives them a chance to trade and profit on the prediction of the market's direction based on economic, political, or other news. However, the premium charged on forex options trading contracts can be quite high, forex options.

The premium depends on the strike price and expiration date. Also, forex options, once you buy forex options option contract, they cannot be re-traded or sold. Forex options trading is complex and has many moving parts making it difficult to determine their value. Risks include interest rate differentials IRDmarket volatility, the time horizon for expiration, and the current price of the currency pair.

Forex Options Trading is a strategy that gives currency traders the forex options to realize some of the payoffs and excitement of trading without having to go through the process of buying a currency pair. There are two types of options primarily available to retail forex traders for currency options trading. Both kinds of trades involve short-term trades of a currency pair with a focus on the future interest rates of the pair.

Not all retail forex brokers provide the opportunity for options trading, so retail forex traders should research any broker they intend on using to ensure they offer this opportunity. Due to the risk of loss associated with writing options, most retail forex brokers do not allow traders to sell options contracts without high levels of capital for protection, forex options.

Let's say an investor is bullish on the euro and believes it will increase against the U. Consequently, the currency option is said to have expired in the money. Your Money. Personal Finance, forex options. Your Practice. Popular Courses. What Is Forex Options Trading? Key Takeaways Forex options trade with no obligation to deliver a physical asset. These options vary widely from one product to another depending on which entity is forex options the option.

Forex options come in two varieties, so-called vanilla options, and SPOT options. SPOT options are binary in nature and pay out or not depending on the forex options condition of the option. Compare Accounts. Advertiser Disclosure ×, forex options. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Terms Currency Option A contract that grants the holder the right, but not the obligation, to buy or sell currency at a specified exchange rate during a particular period of time.

For this right, a premium is paid to the broker, which will vary depending on the number of contracts purchased. Exotic Option Definition Exotic options are options contracts that differ from traditional options in their payment structures, expiration dates, and strike prices.

Binary Option A binary option is a financial product where the parties involved in the transaction forex options assigned one of two outcomes based on whether the option expires in the money. How Single Payment Options Trading Works Single payment options trading is a type of option product that allows an investor to set the conditions to be met in order to receive a payout, forex options, as well as the size of the payout.

Forex options Premium Definition The spot premium is the money an investor pays to a broker in order to purchase a single payment options trading SPOT option. What Is an Average Rate Option ARO? An average rate option ARO is a financial product that is used to hedge against the risk of adverse foreign currency fluctuations.

Partner Links. Related Articles. About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice. Investopedia is part of the Dotdash publishing family.

Hedging Forex Risk through Currency Options

, time: 36:33FX option expiries for 26 April 10am New York cut

26/04/ · FX option expiries for 20 April 10am New York cut; Central Banks. Bank of Japan monetary policy meeting concludes Tuesday 27 April - preview; Federal Reserve FOMC meeting Wednesday 28 April FX Options are also known as Forex Options or Currency Options. They are derivative financial instruments, in particular, Forex derivatives. With an FX Option, one party (the option holder) gains the contractual right to buy or sell a fixed amount of currency at This kind of currency option works best in a scenario where you expect the value of a currency like the INR to strengthen vis-à-vis another currency. The other type of currency option is the call option, which gives you the right to buy currency at a certain rate. This works when you expect the value of the INR to weaken against another currency like the dollar. How to trade in currency options.

No comments:

Post a Comment