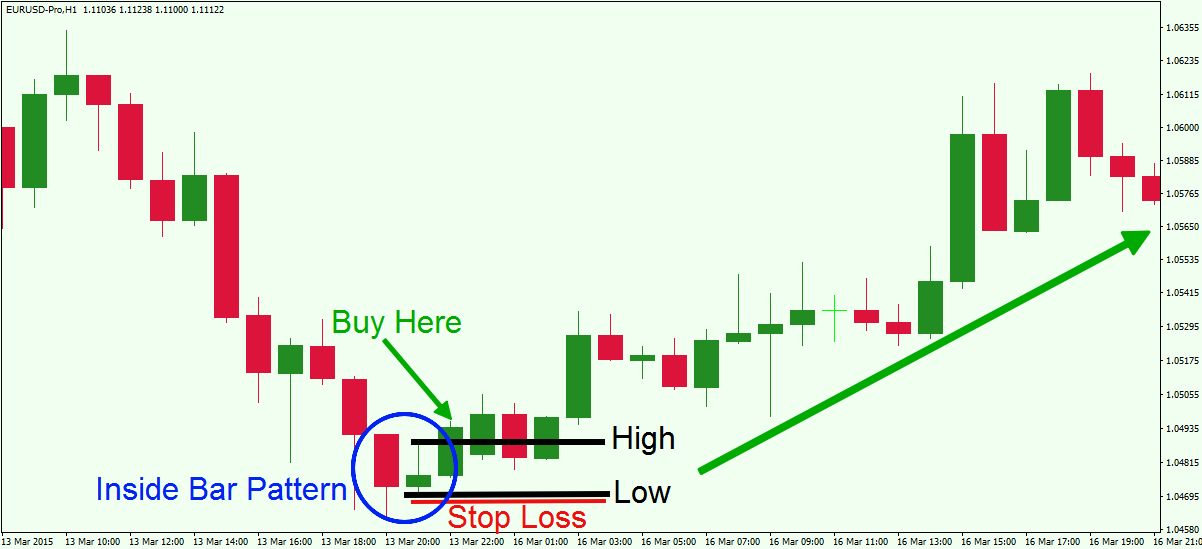

to place a pending buy stop order just above the high of Bullish Outside bar and a stop loss just below it. For a Bearish Outside bar place a sell stop order just below the low of the Bearish Outside bar and a stop loss just above the high of the Bearish Outside Bar. Share your opinion, can help everyone to understand the forex strategy · The Outside Bar Forex Swing Trading Strategy is a combination of Metatrader 4 (MT4) indicator(s) and template. The essence of this forex strategy is to transform the accumulated history data and trading signals This outside bar forex trading strategy is a simple trading strategy and its easy to spot the pattern setup and and also has simple trading rules which beginner forex traders can find easy to use. The concept of the outside bar forex trading strategy is the same to that of the inside bar forex trading strategy but the pattern setup is the opposite

3 Outside Bar Trading Strategies -

How can you tell if a system that you just learned, will work for you or not? The first step is to create a backtesting plan. In this post, forex outside bar strategy, I'll show you my simple plan for an Outside Bar forex outside bar strategy strategy. Feel free to follow along and You have watched a ton of YouTube videosread what seems like a million blog posts, and learned countless trading strategies.

They learn a plethora of different trading systems, then they try each one out for a few days, forex outside bar strategy. You just bought yourself a ticket on the Trading Silodrome. Learning to trade a technical trading strategy successfully, is a 7-step process:.

Anyone who tells you that you can just grab the PDF in 1 and jump straight to 6 is either just trying to sell a course, forex outside bar strategy, or forex outside bar strategy forgot what it is like to actually go through the entire process. There is plenty of advice out there on the internets. Alright, first we need to define a few things for this Outside Bar forex outside bar strategy strategy. It is based on the Big Shadow strategy that I learned from Walter.

To make a custom plan of your own, you can download this worksheet. The generic definition of an Outside Bar is a bar or candle where the high and the low of the current candle is both higher and lower than the high and low of the previous candle. This is the preferred type of candle, at least for this strategy.

In this trading strategy, we are going forex outside bar strategy look for Outside Bars that have the following characteristics:. Your goal at this point should just be to get through one round of backtesting on one currency pair, on the daily chart. In this strategy, we are going to only look for Outside Bars in trending markets. This is where the EMAs help. They are totally optional, forex outside bar strategy, but forex outside bar strategy there is good separation between the EMAs, that is a good sign that you are in a trending market.

Again, it will take some practice to learn what a strongly trending market looks like, but the EMAs give us a good reference point. It also helps to learn how to read price action. This course and this course are excellent for that. Enter on a pending order, when the price of the next candle breaks the high of the Outside Bar plus 5 pips for a long, or the low of the Outside Bar plus 5 pipsfor a short.

There also needs to be a support forex outside bar strategy for a long and and resistance zone for a short. Outside Bars in between zones will not be considered. Equal to the stop loss, forex outside bar strategy, plus 5 pips. Only looking for a 1R target in this version of the strategy. I will test as many pairs as I can get data for. Stay tuned to future blog posts for the results of the Aardvark. If you want to see an Outside Bar chart analysis on the EURUSD weekly chart while you wait, read this.

Remember, backtesting does have limitations. But it is the key first step in determining if a trading system could be viable or not. If you have zero data about a system, you are flying blind. Also keep in mind that your backtesting results may be very different from mine.

That is because people see the markets differently and can interpret the same set of rules in very different ways. That is why it is so important for you to backtest a strategy for yourself and not listen to anyone on the internet! To learn all 7 steps in the Forex Trading Strategy Development process, sign up for our FTSD program.

Disclaimer: Some links on this page are affiliate links. We do make a commission if you purchase through these links, but it does not cost you anything extra and we only promote products and services that we personally use and wholeheartedly believe in. A portion of the proceeds are donated to my charity partners. Hi, I'm Hugh. I'm an independent trader, educator and international speaker.

I help traders develop their trading psychology and trading strategies. Learn more about me here. Get the FREE Guide to Picking the Best Trading Strategy For YOU. Skip to primary navigation Skip to main content Skip to footer Trending Outside Bar: Forex Trading Strategy Plan Version 1 How can you tell if a system that you just learned, will work for you or not?

SEE ALSO: The Top 7 Manual Backtesting Software Solutions Compared. SEE ALSO: The Best Trading Psychology Books of All-Time. Related Episodes. Is the Entry or Exit More Important in Trading? Share This Article.

First posted: October 5, Last updated: February 21, Get Instant Access.

Learn To Trade Outside Bars - Reversals and Continuations

, time: 9:33Trending Outside Bar: Forex Trading Strategy Plan (Version 1) « Trading Heroes

· The Outside Bar Forex Swing Trading Strategy is a combination of Metatrader 4 (MT4) indicator(s) and template. The essence of this forex strategy is to transform the accumulated history data and trading signals to place a pending buy stop order just above the high of Bullish Outside bar and a stop loss just below it. For a Bearish Outside bar place a sell stop order just below the low of the Bearish Outside bar and a stop loss just above the high of the Bearish Outside Bar. Share your opinion, can help everyone to understand the forex strategy · In this trading strategy, we are going to look for Outside Bars that have the following characteristics: The candle closes near the top for a long, near the bottom for a short. The two previous candles (marked as 1 and 2 above) have lower highs for a short and higher lows for a long

No comments:

Post a Comment